September 21, 2023

Why Retailers Should Embrace the Experience Economy

By Liza Colburn

Consumers have been changing what they spend their money on. From the rise of minimalism to ever-increasing travel spending, consumers have become more intentional about what physical items they purchase and have shifted their focus to collecting a wealth of experiences. This has created an experience economy.

What is the experience economy?

The experience economy refers to the sale of memorable and meaningful experiences to consumers. Separate from goods or services, experiences are in a category of their own. What defines each of these categories is the value they deliver. In the case of a service, value is measured by time saved and often convenience. For an experience, value is measured in time well spent. For example, taking an Uber to the beach is a service, while taking a surfing lesson at the beach is an experience.

The growth of the experience economy

Experiences are in high demand, and they are expected to grow. According to CNBC, revenge travel (i.e. making up for travel lost to the pandemic) is here to stay as consumers continue to book trips and experiences despite inflation. Airlines report strong profits as people keep prioritizing travel. According to Persado’s 2023 Consumer Travel Survey, personal debt and other economic factors had little impact on travel spending.

It isn’t just travel that fuels the experience economy, however. People are also spending big money on experiences close to home. Taylor Swift fans report spending around $1,300 per show on tickets, outfits, refreshments, merchandise, and more. Seventy-one percent of them say it was worth it, because the experience was so rewarding.

Even the holiday shopping season, once synonymous with physical gifts, isn’t immune to the experience economy. In fact, a growing share of consumers want experiences and entertainment, not just physical goods. This is evident in the share of consumers buying restaurant or entertainment gift cards. Major airlines, cruise lines, resorts, and hotel chains also promote Black Friday and Cyber Monday deals, along with local coffee shops and restaurants.

What does this mean for retailers? Contrary to what it might seem, the experience economy presents a huge opportunity for retailers to evolve and grow.

How top retailers embrace the experience economy

Retailers don’t need to view experiences as 1:1 competition for the consumer share of wallet. After all, people often need physical goods to fully enjoy experiences. An enjoyable day at the beach includes swimsuits, beach chairs, sunscreen, towels, hats, and more. In this way, the retail industry and the experience economy go hand in hand. Retailers can lean into the points of overlap by selling experiences alongside merchandise and marketing merchandise for experiences (i.e. outfits for music festivals).

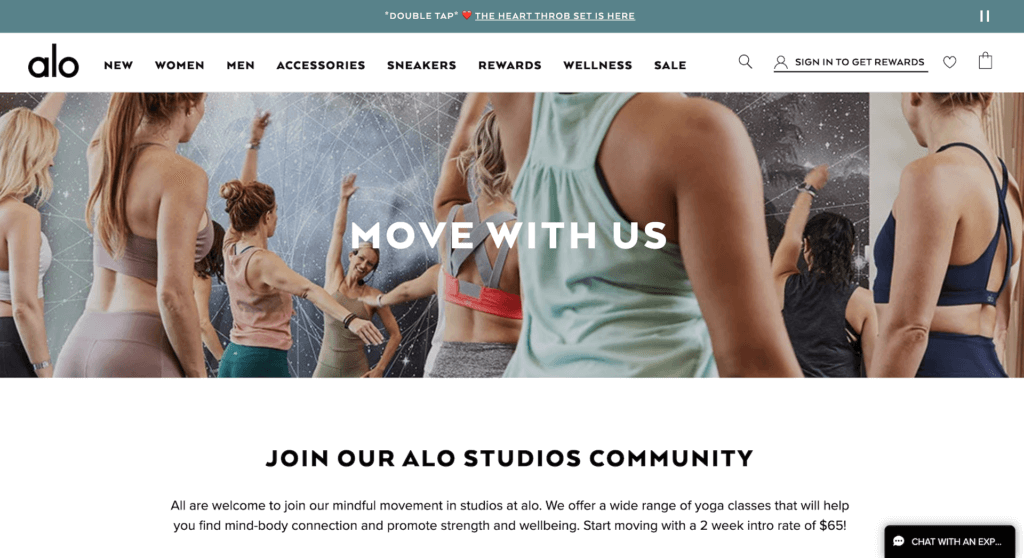

Fitness and athleisure brands have been leading the charge for years. Athleisure brand Alo offers yoga classes in Alo studios, luxurious mixed-use spaces that rival top yoga studios. Customers can drop in for a class and shop for new leggings during their visit. Customers who don’t live near an Alo studio can stream classes from anywhere and still share in the experience and community.

Other athleisure companies embracing the experience economy include Athleta, which also hosts in-store events and fitness classes. Lululemon partners with well-known studios and instructors to stream coveted fitness classes on lululemon Studio Mirror and on the lululemon Studio App.

Saks Fifth Avenue turned its famous Fifth Avenue store into a beauty and wellness destination. Featured partnerships with SKINNEY Medspa, Blink Brow Bar London, Kure Bazaar Nail Salon, Honeybrains, and others drive more customers into the store to enjoy these experience offerings. They also enhance the Saks Fifth Avenue brand by having these luxury services available to customers alongside the highest quality physical items.

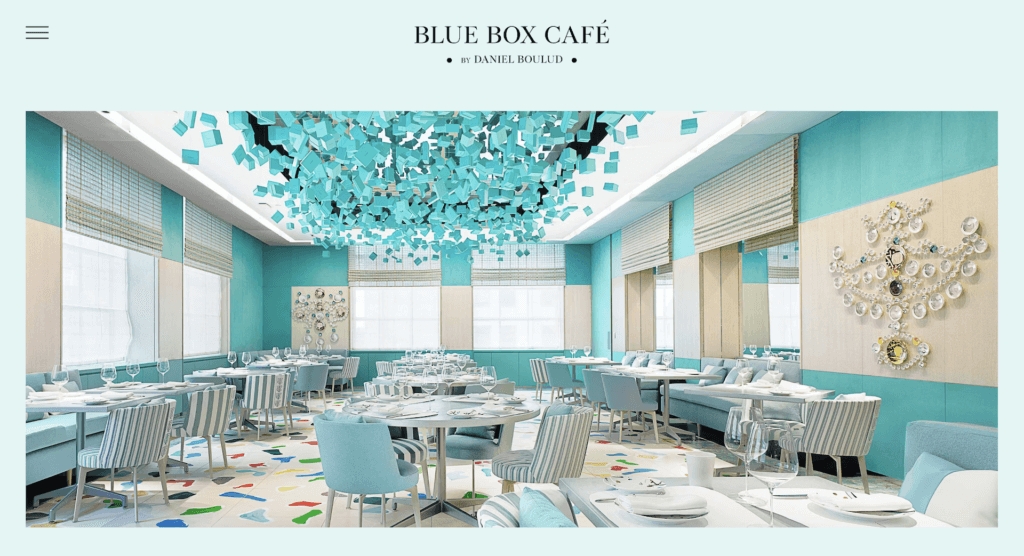

Several Nordstrom locations have followed suit with full-service spas and restaurants. Tiffany & Co. customers can literally have breakfast at Tiffany’s at The Blue Box Café.

The experience economy isn’t just for high-end brands. Walmart Supercenters are also home to hair and nail salons, Subway, McDonald’s, and Burger King locations. Target has a licensing agreement with Starbucks; 1,700 Target stores have Starbucks locations. That’s the vast majority of the big box retailer’s 2,000 stores.

Brand partnerships connect retailers with experiences

Brands looking to dive into the experience economy don’t have to do it alone. Retailers can partner with non-competitive, complementary brands that also cater to the same target audience. For example, a luxury swimwear brand could partner with a luxury resort. Both have the same target customer and complement one another, but offer something completely different.

Costco Travel, for example, offers members deals on vacation packages and rental cars delivered by travel partners. More retailers are likely to follow this model of partnering with travel companies to cross promote. Customers will be able to book a trip in-store or on the retailer’s website and buy all the clothes and accessories they need for the trip in one place. The travel partner will also promote the retailers’ goods on their website and at their vacation properties.

This concept of booking a trip or experience and buying everything you need for it in one place adds value to customers through more convenience and time savings. It also exposes both brands to new and engaged audiences.

5 reasons the experience economy is vital to the future of retail

Despite the decline of malls and the growing popularity of online shopping, shopping in-store is here to stay–at least for the near future. However, a good in-store shopping experience simply isn’t always enough to get customers in the door. Retailers should think beyond the traditional in-store shopping experience and start creating branded experiences that stand on their own and drive revenue and in-store traffic no matter if a customer purchases a physical product or not.

1. Consumers already have too much stuff

Consumers find that buying less benefits the environment, helps balance budgets, and contributes to overall happiness and well-being. While people are still interested in shopping for new items, they want to feel reassured that they are receiving value for their money and are buying items that will last. US-based consumers have a long history of buying too much stuff. They are acquiring so much stuff that the self-storage industry has grown exponentially. Today, nearly 10% of US-based consumers rent a storage unit and there are approximately 50,000 storage facilities in the US. In 1984, there were only 6,600.

However, consumers seem to be getting away from past habits of buying more stuff and are becoming more intentional about what they buy and keep in their homes. Media figures such as Marie Kondo are fueling this movement and social media influencers are now “de-influencing” by sharing their honest opinions on what not to buy. Retailers should provide an experience alternative to acquiring new stuff as people become more mindful.

2. Experiences drive demand

Experience-oriented offerings act as a built-in marketing tool. They drive demand from quality consumers in the brand’s target audience. Customers come in for the experience and often leave with merchandise, even if they didn’t originally plan to do so.

3. New streams of income

The experience economy allows retailers to sell something even if it isn’t a physical product. For example, if someone recently bought new yoga pants, they still might spend money at Alo by taking a class at the Alo studio. While a customer might only buy new athleisure from time to time, they might come in for a yoga class multiple times a week. When experiences stand alone as separate products under the brand umbrella, retailers can sell more to their customer base more often and create new revenue streams.

4. Brand positivity and growth

Great brand experiences create buzz and attract new customers to the brand. They are also great content opportunities for brands, influencers, and customers to share the brand experience across social media, driving additional interest and growth. Experiences act as conversational marketing tactics. Like the language used across digital marketing campaigns, experiences engage customers and make them feel good. Such positive connotations also spark the interest of new customers in the brand.

5. Keep physical stores relevant

Consumers still like shopping in-store, but they no longer need to shop in-store. It benefits retailers to keep their stores relevant. Customers tend to pick up additional items when shopping in-store since they physically see and touch the items. Physical stores are an important part of the supply chain as they reduce the cost of inventory management and returns.

It’s time for retailers to start thinking about experiences as products too. Selling world-class experiences alongside world-class products is a win/win for retailers and customers. Consumers want to interact with and support the brands they love, but acquiring new items might not always be the default anymore and that’s okay. The experience economy is a huge opportunity for brands to capitalize on and transform retail locations from stores to destinations.