January 26, 2024

Financial Services Marketing: Everything you Need to Know About Promoting Personal Finance Products

By Liza Colburn

Personal finance is less about the products themselves and more about customer financial needs and goals. Financial services marketing allows financial institutions to educate consumers about how personal finance products can enable them to achieve their goals. But, it goes even further than that. In order to capture engagement and conversions, financial services marketers must understand the nuances between the various channels, consumer segments, life stages, behavioral data, and more.

Emotions around money influence financial services marketing

Feelings about money can be complicated. Consumers’ emotions around money can bring out a darker side or result in impulsive decisions. However, those same emotions also motivate people to save and invest to provide a more stable future. According to Vanguard, even the most experienced and successful investors feel both anxiety and euphoria when it comes to their money.

Vanguard research also found that about 40% of the value a financial advisor provides to a client is emotional. This is because financial advisors make their clients feel “more confident with their portfolios, satisfaction with their choices, and excitement for the future.” By enabling customers to make educated decisions about personal finance, marketers with financial institutions can do the same.

5 digital marketing strategies and examples for personal finance

Consumers want to feel like the financial institutions they frequent understand and value them. They also want product information and the user experience to be straightforward. The more financial marketers can position their products in ways that ordinary consumers can understand, the more they will build loyalty and drive growth. Let’s dive into some proven digital marketing strategies to do just that.

1. Personalized messaging and AI-optimized content

In marketing, as in life, it’s not just what you say, it’s how you say it. Throughout Episode 6: The Impact of Consumer Psychology and Emotions on Marketing Performance of Persado’s Motivation AI Matters podcast, Linda Itskovitz, VP of Marketing at Quicken, shares the pivotal role language plays in impacting and understanding consumer behavior. She discusses how different customer segments respond to messaging based on the digital channel. For example, customers who gravitate to certain channels are often focused on a specific benefit or product. According to Linda, for example, TikTok attracts a younger audience. Since Gen Z is very focused on saving money, Quicken’s TikTok audience responds best to messaging about saving money. Reddit has a bit of an older following. Many subreddits are focused on investing. So a company like Quicken can get a better response on investing topics on Reddit than on TikTok.

Linda also shares how small variations in language perform across separate segments and demographics. Gen Z and millennials want to “stay on top of their finances” while baby boomers want to “take control of their finances.” This contrast in messaging shows how different segments approach and value similar products. The success of varied messaging also confirms the increasing demand for marketing personalization. While the financial product may not be vastly different, the marketing language adjusts to cater to the audience or channel. Here are some more examples of finance marketers enabling personalization.

Generative AI language optimization

Insights into what different segments value and which messages they respond best to promotes personalization which ultimately drives growth. The instinct of human marketers alone doesn’t always get this right. Humans alone can’t always predict which marketing messaging will drive optimal conversions across each digital campaign. Plus, it can be challenging to create the volume of content needed for marketing personalization across an ever-growing number of segments and digital channels.

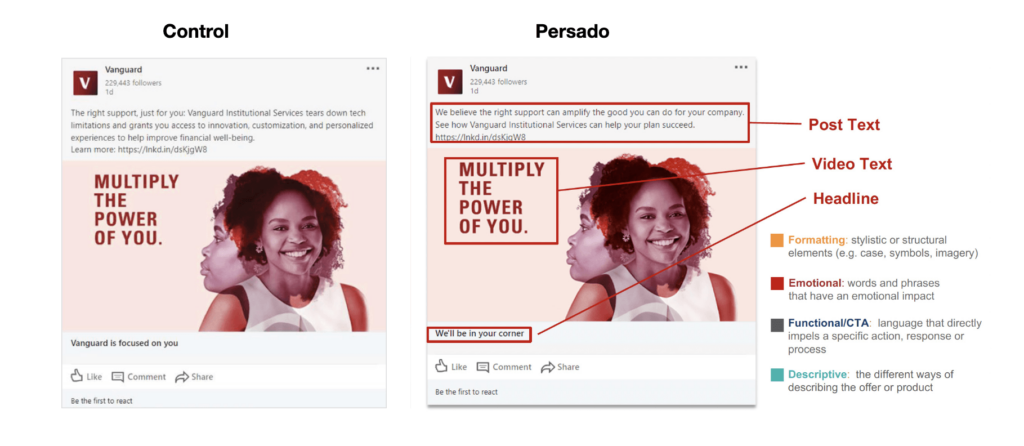

Persado Motivation AI, a specialized class of enterprise Generative AI trained on over 10 years of insights from real Fortune 500 digital campaigns, generates AI-optimized language for emails, ads, social media, and more. It is proven to motivate customers to take a desired action. These actions can include completing an application, opening an account, redeeming credit card points, etc. Vanguard saw a 16% increase in conversions across their LinkedIn ads using Persado AI-generated messaging.

Persado Essential Motivation, the self-serve GenAI platform leveraging the Motivation AI knowledge base, allows enterprise brands to unlock both the efficiency and effectiveness of Generative AI. It generates language at scale that is predicted to outperform human-generated controls 96% of the time. Many of the world’s largest financial services companies trust Persado because it increases conversions and revenue across channels. It also meets the sector’s high security and compliance standards.

2. Content marketing and SEO

Customers may not know the difference between terms such as APR and APY. What about a Roth IRA vs. a traditional IRA? However, those interested in personal finance products are searching for answers. According to Semrush, 66% of all web traffic referrals come from Google. 5.9 million Google searches take place every minute. Close to 50% of Google searches have local intent, which is important for financial institutions with physical branches.

Creating SEO-friendly content that educates customers on personal finance, defines terms, shares the pros and cons of various products, etc. in digestible ways not only brings customers to the website, but also keeps them engaged and builds trust once they are there.

Financial recommendation websites such as NerdWallet, Policygenius, and Credit Karma built trust and SEO through consistent content marketing. Their content educates consumers on complicated concepts and guides readers to the personal finance products that could be right for them. Their content is honest about the pros and cons of personal finance products and who they are and aren’t a fit for. These honest reviews bring value to consumers by helping them identify a short list of products that will be most beneficial to them at that time.

Many financial institutions are following the same strategy. Prudential dedicates much of their website to articles, tools, and other resources focusing on financial education. Charles Schwab covers countless personal finance topics throughout the Insights and Education section of their website. They also cover them on their numerous podcasts. Mobile optimization, voice search, and video SEO are more of the top SEO trends financial marketers should consider.

More content marketing topics

Other topics outside of traditional financial planning or the products themselves also perform well in financial services. High-quality educational content around well-being such as budgeting tips, ways to get out of debt, home renovation, or travel tips are also popular content strategies used by financial institutions. Some examples include:

- Financial technology company, Chime, shares wealth-building tips primarily targeted toward Gen Z.

- Fidelity Investments has a financial basics hub with tips for budgeting, managing debt, retirement planning, and more. Customers can also tune into their YouTube channel or other digital channels for useful financial advice.

- JPMorgan Chase shares travel tips alongside advice for homeowners and car buyers. Their Instagram is filled with quick tips to help consumers meet their financial goals.

Thought leadership

In financial services, thought leadership often explores macro-level economic and social trends. On the recent Motivation Matters podcast, Linda shared the approach to a Quicken study on how job loss could impact marriage. The goal was to understand how layoffs were affecting relationships. These kinds of thought-provoking studies not only act as original content for content marketing, but also are excellent PR tools that can generate media interest.

By providing this kind of insight, financial services marketing can give customers confidence in their knowledge of personal finance and in the institutions they have accounts with. Sharing valuable advice and knowledge in simple ways across various formats (i.e. long form video, short form video, podcast, blog, newsletter, etc.) and channels enables financial institutions to attract and retain customers.

3. Refer-a-friend incentives

Consumers are known to turn to trusted friends and family for advice on products and services. Financial institutions should not only encourage these kinds of referrals, but also reward customers for getting someone in their social circle to open an account. The following brands use alluring incentives to get customers to refer friends:

- Goldman Sachs brand, Marcus, offers an additional 1.00% APY for three months on their high-yield savings accounts when customers refer a friend as part of their Marcus Referred program. Marcus customers can find a unique referral link in their dashboard, send it to a friend, and both the customer and their friend will receive an additional 1.00% on their Online Savings Accounts for three months after the friend opens a new account.

- Chase Sapphire® credit cards have a similar model where customers looking to refer a friend can find their unique referral link in their dashboard. Chase Sapphire® customers can earn up to 75,000 bonus points per year by referring friends (15,000 points for each friend that gets approved).

Refer-a-friend programs encourage, enable, and reward personal finance customers to sell your products for you. The trust that already exists between friends and family is truly unique to refer-a-friend programs and can’t be recreated across any other strategy, channel, or campaign. This makes it ideal for financial services marketing. These programs also cost less than traditional marketing programs. For best results from referral programs, finance marketers should properly track referrals, make it easy for customers to refer friends and get rewarded, and provide incentives customers actually want.

4. Consistency

Large financial institutions have an array of product offerings from checking accounts and savings accounts to wealth management and investments. While it might be tempting to mix different products into a customer acquisition campaign, variations in products might confuse potential customers and cause them to drop off. Linda shared findings on the Motivation AI Matters podcast showing that if a customer clicks on a campaign about saving money and the next message they receive is about investing, they are likely going to lose them.

Financial services companies should feature consistent product categories throughout customer acquisition campaigns in order to get more customers to convert. Once potential customers become new and engaged customers, they can be introduced to additional products that can complement what they are already using.

5. Premium digital user experiences

Not so long ago, customers chose financial institutions based on which had branches geographically closest to them. They needed convenient access to the ATM and to bankers in order to withdraw money, make deposits, open accounts, etc. Today, digital-first customers look to seamless online user experiences for convenience rather than geographic access. Fintechs may have pioneered the digital-first user experience, but today’s brick-and-mortar financial institutions have followed suit with simple and secure in-app experiences. Investing in UX helps customers feel in control of their personal finance accounts and helps financial institutions engage and retain customers.

Interactive experiences also go a long way. Merrill, for example, has a Personal Retirement Calculator, a Retirement Account Selector, and other investment tools that customers and potential customers can use throughout their financial planning journey.

The importance of digital marketing for financial services companies

Talking about money and the emotions that come with it can be challenging, especially across various channels, marketing segments, products, etc. Today’s digital-first customers demand personalized messaging and educational content that gives them confidence and insight into their personal finance decisions. Customers also want to stay connected to their finances through convenient and user-friendly in-app experiences. For more on the financial services marketing examples shared above, listen to the full episode of the Motivation AI Matters podcast featuring Linda Itskovitz, VP of Marketing at Quicken.

To bring the highest-converting AI-optimized language to your financial services campaigns, request a risk-free trial of Persado Motivation AI, the market leader in Generative AI for Text Content Generation, according to CB Insights.