January 29, 2024

Generative AI for Credit Cards: Optimizing Marketing & Customer Engagement

By Liza Colburn

The credit card business has seen its ups and downs in recent years. Growth in debit-first digital wallets like ApplePay, Google Pay and PayPal, Buy Now Pay Later (BNPL) alternatives, and higher interest rates have challenged credit’s dominance as the e-commerce payment method of choice. Combine that with COVID-19-related spending declines and balance payoffs, and credit has faced some tight years. Now on the upswing as consumer spending stays strong and savings rates decline, credit card firms need new strategies for acquiring new customers and encouraging them to use your card first. Generative AI for credit cards provides a new tool for doing that.

What is Generative AI and how can credit card companies use it?

By now, everyone knows that Generative AI (or GenAI) is a form of artificial intelligence that can generate original text, images, videos, computer code, and other outputs in response to natural language prompts. GenAI solutions are built on natural language processing algorithms. They use machine learning and neural networks—among other forms of AI—and built on large language models.

While the Big Tech firms like Microsoft, Google and Meta have some of the best known GenAI large language models, many specialized solutions built on proprietary technology also exist. These deliver Generative AI for specific use cases and industries. Persado is one of them; it specializes in AI-generated language for marketing and customer engagement.

How Generative AI can drive revenue in the credit card business

For credit card marketing and CX leaders to understand where to apply GenAI to create business value, it helps to think in terms of sources of profit. [Note, we are focusing on customer-facing credit card issuers in this note, not on network providers.]

They can include:

- Annual fees

- Interchange fees charged to merchants every time a customer swipes your card

- Finance charges charged to customers when they don’t pay the full balance at the end of the month

- Late payment or underpayment fees

Your credit card company grows revenue and profit in the first two domains when you increase the number of customers you have overall. Also, when you increase the frequency with which each customer chooses your card over an alternative payment method. In other words, it is about customer acquisition and motivating loyal use.

In the case of the third and fourth source of value to do with payments and collections, that one is about motivating behavior. The right messages in the right frequency with the right timing can help customers stay up-to-date with minimum payments. Credit card companies want to do this without discouraging those with good credit from carrying a balance.

Generative AI for credit cards can help improve your execution in all of these areas of customer acquisition, customer loyalty, and behavior motivation. They enable you to more quickly and easily increase the volume of campaigns you create while maintaining your brand standards.

Persado’s enterprise Generative AI solution can help drive scale and higher average conversion rates per campaign. It does that by assessing what your brand is trying to achieve with a campaign. It then generates alternative versions that tap into the stories and emotions that motivate customer action. Our machine learning algorithm specifically chooses the words and word phrases most likely to drive engagement, according to more than ten years of campaign data.

More on that as we look deeper at each of those key activities of acquisition, loyalty, and behavior motivation through the lens of increased campaign volume and increased campaign impact.

Generative AI for credit card customer acquisition

There is so much competition between credit card companies today, in part because there are so many great options. Loyalty or points programs are nearly universal product features for customers with good to excellent credit.

Cards issuers cannot just rely on product features to appeal to customers, however. They are too common or too easily replicable. You gain better results by marrying a great product with stronger messaging to attract attention.

Generative AI can help. When used for text, GenAI is a powerful automation tool. With a prompt describing what you want, or even a first draft example, marketers can use a GenAI solution to generate a dozen alternative text messages or subject lines in seconds.

Marketers have a number of options of what they can do with all those versions. You can review and combine the options to come up with a single winner to use for a broadcast campaign. You can take multiple options and use them to target different customer segments. Persado also gives you a few additional alternatives.

How Persado delivers Generative AI for credit card customer acquisition

Our self-service solution, Essential Motivation, gives credit card marketers direct access to a secure and industry-compliant GenAI specially trained on Fortune 500 marketing content. With it, marketers can input example language or issue prompts to generate messages predicted to outperform the original. Our user interface even scores each version to help you decide which ones to use for your campaign.

Credit card brands can also run an experiment with multiple Persado AI-generated variants to compare your audience’s reaction to them. Using experimental design features built into the Persado platform, brands can see which version performs the best. We also show you which element of the message had the biggest effect. Experiments can also allow brands to gauge engagement from different customer segments.

For example, a Fortune 50 bank worked with Persado to generate and experiment with options for a Facebook ad. The campaign aimed to increase applications for a newly launched credit card. Using the Persado Motivation AI Platform, the bank tested multiple AI-generated options for the campaign. The ultimate winner increased conversions by 85% above the credit card firm’s human-generated control message. The cost per click costs were also lower by about 35%.

Generative AI for credit card customer loyalty

Generative AI for credit cards can also help firms increase loyalty. We mean loyalty in the expansive sense of the word. As in, your customers use your card more often and for larger purchases.

As with acquisitions, loyalty-driving product features help encourage usage—up to a point. Cash back, discounts with partner retailers, and travel rewards all motivate different segments of the consumer market. These programs are so common, however, that credit card firms need additional tools to capture customer attention.

A high-quality GenAI solution can help credit card marketers produce more content for their campaigns and keep their brand top of mind. Combining more with better, however, is the key to loyalty. Better requires finding the right angle to appeal to a customer in the moment. It also requires Generative AI for credit cards trained to optimize messages and motivate customers to take action.

As far as we know, Persado is the only Generative AI for credit card firms with the track record of delivering better, more effective language that can directly contribute to growing revenue. Use cases include helping credit card firms increase card usage and customer loyalty. Persado content can also encourage customers to redeem points for travel, concerts, etc. That is key, as unused points can become a liability over time.

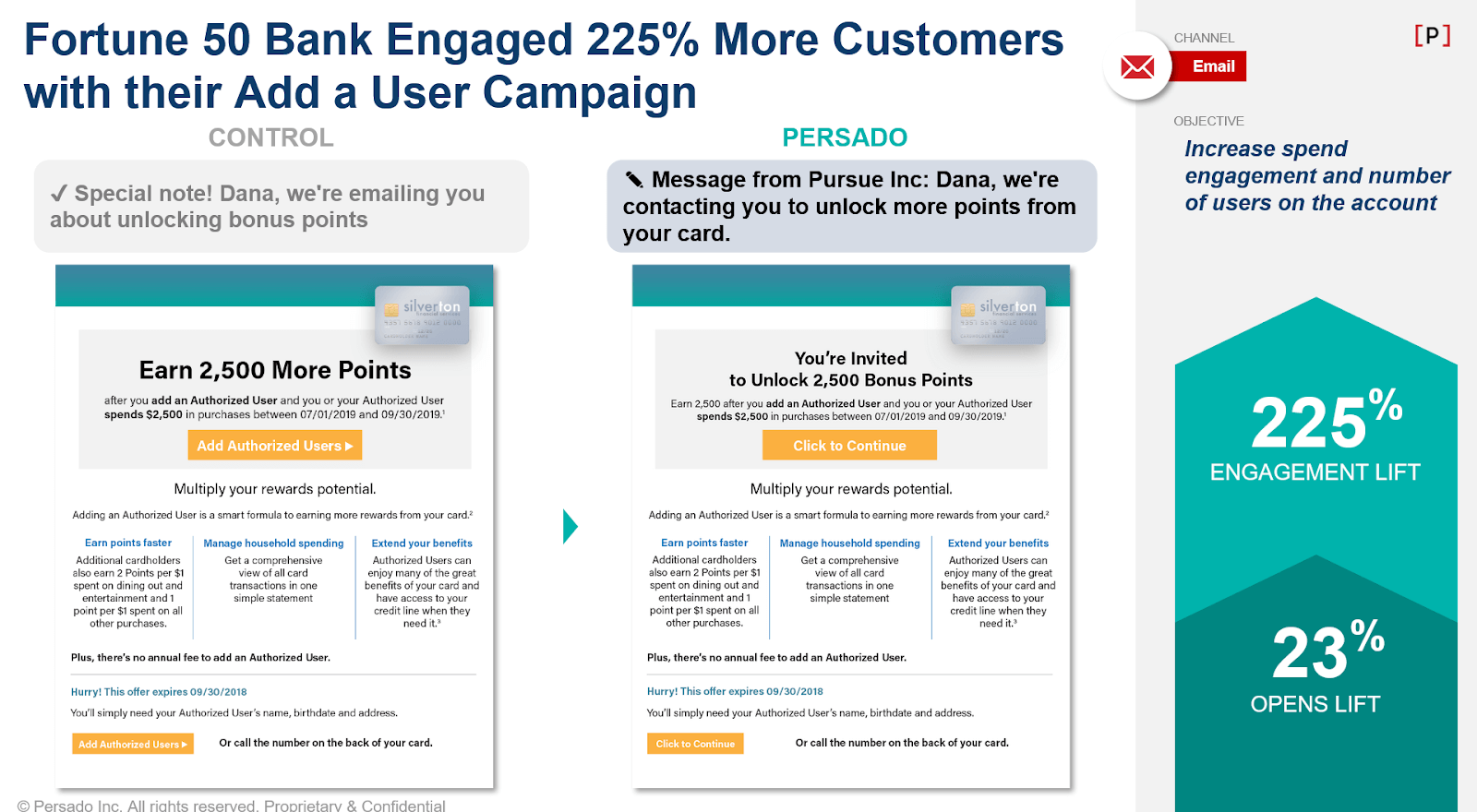

Persado increases engagement with a credit card loyalty campaign by 225%

A Fortune 50 credit card issuer worked with Persado on an email marketing campaign to increase spend engagement for a credit card product. The campaign offered the customers a rewards bonus for adding an authorized user and spending $2500 within a certain time period.

The Persado-generated subject line and body copy—informed by 10+ years worth of data on messages that drive action—produced 23% higher email opens and 225% higher engagement.

The impact of personalization on loyalty

The potential to deliver content personalization is another key benefit of Generative AI for credit card companies.

In order to achieve personalization, brands need two things. First, they need insights into their customer’s needs and preferences. Second, they need the capacity to create enough content that they can activate those customer insights with personalized messages.

The limits of human scale have prevented many companies from fulfilling the latter requirement. Generative AI removes that barrier. Marrying customer insights with Generative AI text automation enables credit card brands to fine-tune their language for different customer segments.

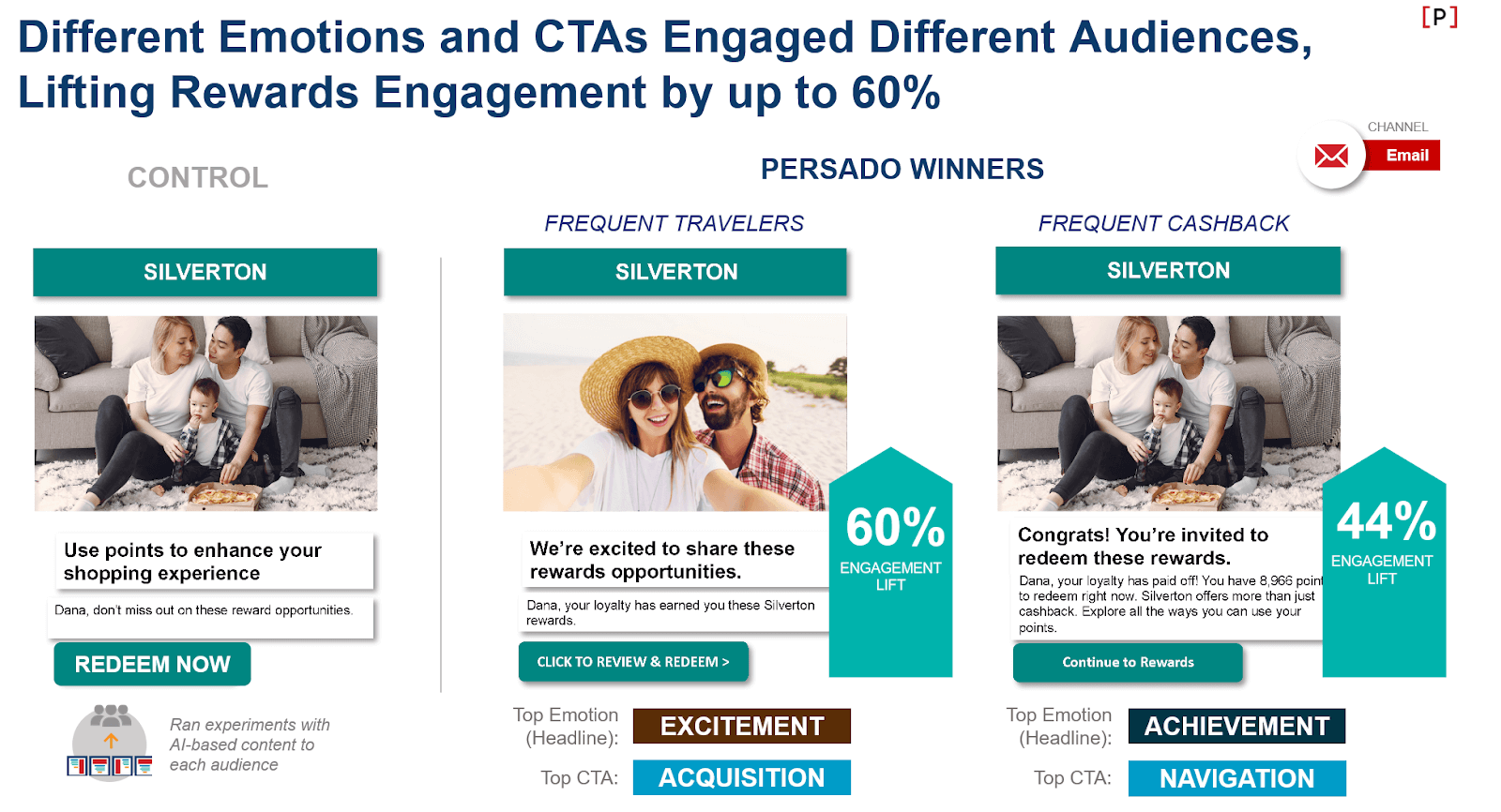

For example, a Fortune 50 credit card issuer worked with Persado to understand whether loyalty card customers who preferred different rewards also responded to different messages. The credit card firm ran an experiment to assess which Persado AI-generated message produced the biggest response for each group.

The experiment found that messages that leaned into a sense of excitement appealed more to members that redeemed rewards points for travel. Messages that focused on achievement, in contrast, appealed to cash-back customers.

Working with Persado to find the best message boosted engagement for both by 60% and 44% respectively above the credit card firm’s human-generated control message.

Achieving personalization in every campaign can be a huge lift, even with the help of Generative AI.

Generative AI for credit cards can motivate on-time payments

Credit card brands can leverage all of the benefits of Generative AI for enabling more communication and better messaging on the services side of your business, including in the payments and collections department. We have written in detail about the power of the Persado Generative AI for payments.

The same capabilities built into the Persado Motivation AI that enable our language model to identify the right words and phrases can also motivate on-time payments. We have worked with credit card brands on campaigns to encourage on-time payments, early payments, and to sign up for auto-pay programs. Check out the blog post for detailed case studies.

Drive more acquisitions, loyalty, and on-time payments with Generative AI

Like many enterprises, credit card leaders are eager to explore how Generative AI can help them drive value. Marketing offers some of the most mature use cases. We at Persado have been working with leading financial institutions for years already, including in their credit card arms. Some of our clients include Ally Bank, JPMorgan Chase, SoFi, and others.

Persado was named the market leader in Generative AI Text Content Generation by CB Insights. Reach out and learn how we can work with you to deliver on-brand and optimized language for engaging your customers. Explore a risk-free trial today.